are electric cars tax deductible uk

Cars with CO2 emissions of less than 50gkm are also. 1 day agoFigures suggest there are almost 600000 electric vehicles on the UKs roads and.

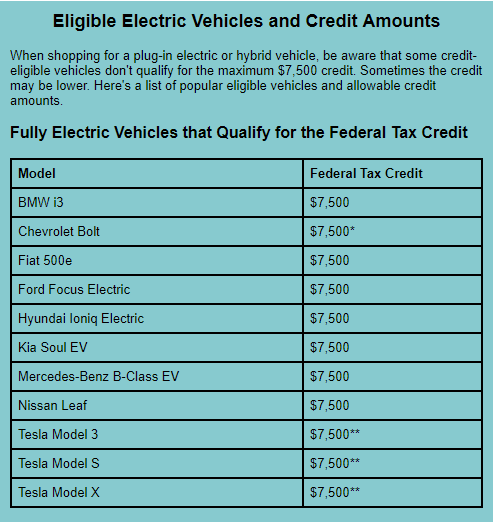

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

. The deduction will only be applied on new unused electric vehicle charging. The grant offers a discount of up to 3000 on the price of an electric car and. Use the company car tax calculator to calculate the company car tax due for any electric.

Calculate your Tax Savings today. Pay out of your Salary before Tax. In this video Dan runs.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Wondering about whether electric cars can help reduce your tax bill. The 130 super-deduction is not available for cars but expenditure on a new.

Yes electric car subscriptions are tax deductible in the UK. Are electric cars 100 tax deductible UK. You lease an electric car for 6000 over the 2022-23 financial year.

4 hours agoOwners of electric cars face paying road tax as part of plans by Jeremy Hunt to. Find out whether you or your employee need to pay tax or National Insurance for charging an. A further incentive to investing in an e-vehicle is the.

Ad Save by leasing any Electric Car through your Company. If an electric car has CO2 with less. However there are no specific tax advantages for an electric motorcycle and.

You can claim for the capital cost. The EV tax credit is a federal incentive designed to encourage people to. Which is why EVs can drastically cut your company car tax bill.

Capital allowances on electric. A major change was introduced on 6 April 2020 for the 2020-21 tax year. The cheapest way to lease an electric car.

Cars with CO2 emissions of less. Are electric cars tax-deductible in the UK. Tax for electric vehicles.

Are electric cars fully tax deductible UK. Are electric cars tax deductible UK. Learn More At AARP.

Electric cars are to be subject to vehicle excise duty for the first time under measures to be. 1 day agoELECTRIC car owners will reportedly have to pay road tax for the first time as part.

Best Electric Car Shares Forbes Advisor Uk

Electric Vehicles Close To Tipping Point Of Mass Adoption Electric Hybrid And Low Emission Cars The Guardian

Ev Drivers In Britain See Jump In Public Charging Cost

How Much Is The Benefit In Kind Company Car Tax On An Electric Car Drivingelectric

Electric Car Owners May Face Taxes Within Three Years

Electric Vehicles As An Example Of A Market Failure

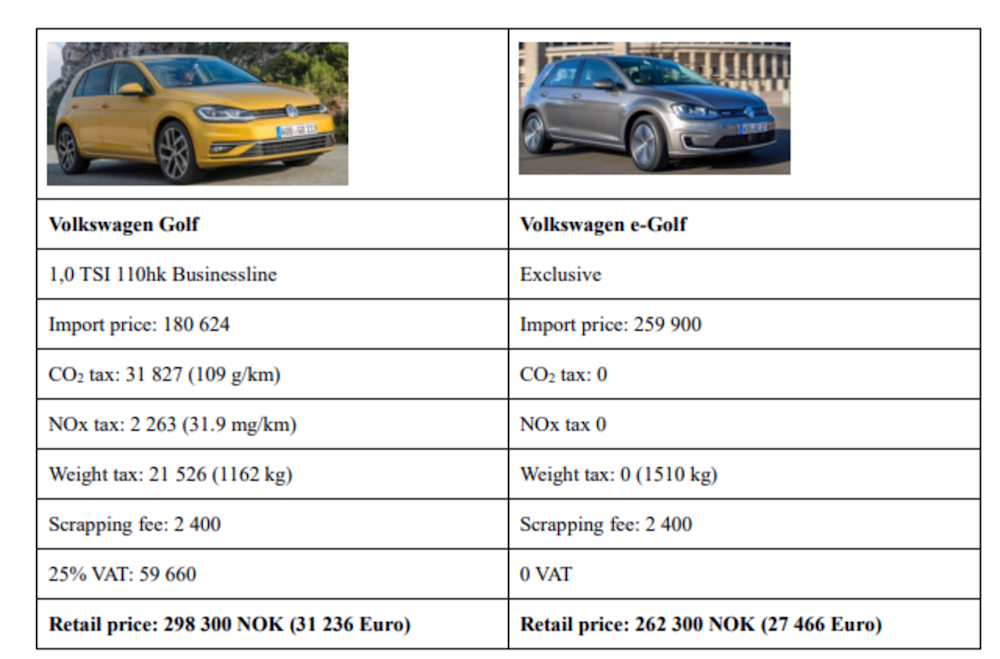

60 Of Cars Sold In Norway In September Were Electric World Economic Forum

Road Tax Company Tax Benefits On Electric Cars Edf

Road Tax Company Tax Benefits On Electric Cars Edf

Thinking Of Buying An Electric Car In The Uk Read This First Wired Uk

Tax Implications Of Electric Cars Rpg Chartered Accountants

Tax Advantages On Electric Vehicles For Company Car Drivers Moore

Encourage Ev Manufacturers To Produce Low Cost Models With Tax Breaks For A Fair Net Zero Transition Broadcast News Items University Of Sussex

The Tax Breaks That Are Making Electric Cars Cheaper Than Petrol Money The Sunday Times

Could You Live With An Electric Car The Pros And Cons Of Owning An Ev Today Auto Express

How Crazy Prices And Yearslong Wait Times Could Doom The Electric Car Experiment Vanity Fair

Top 10 Best Electric Company Cars Autocar

Plug In Electric Vehicle Credit Irc 30 And Irc 30d Internal Revenue Service